child tax credit 2021 eligibility

These payments will amount to half of the credit. This means that consumers who were enrolled in coverage through Get Covered New Jersey earlier in the year may have been eligible for additional Premium Tax Credits at tax time for.

Information On The Child Tax Credit And Eligibility Newsletter Archive Congressman Jamie Raskin

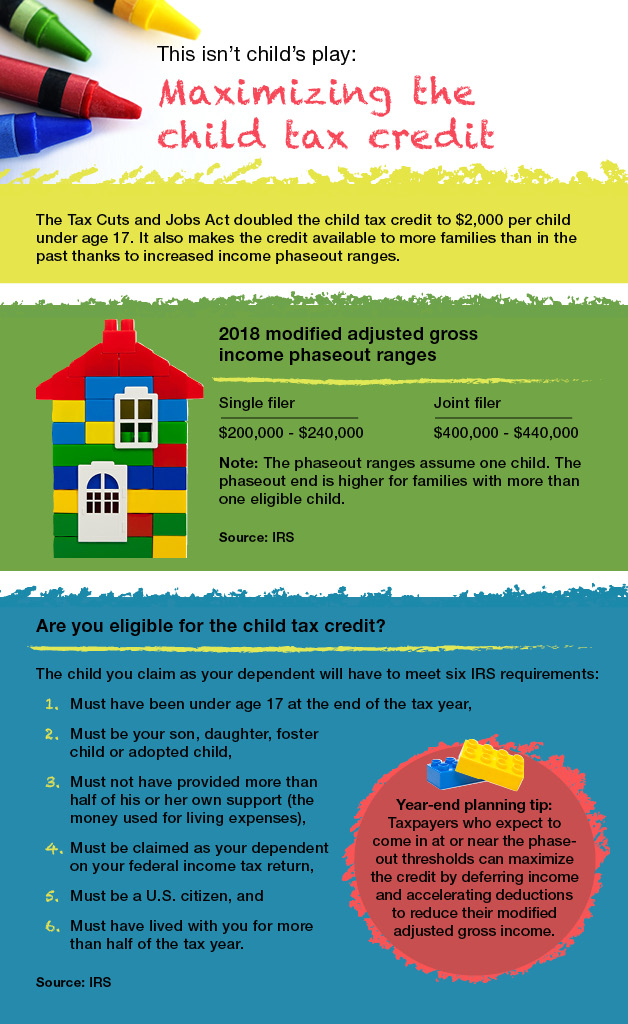

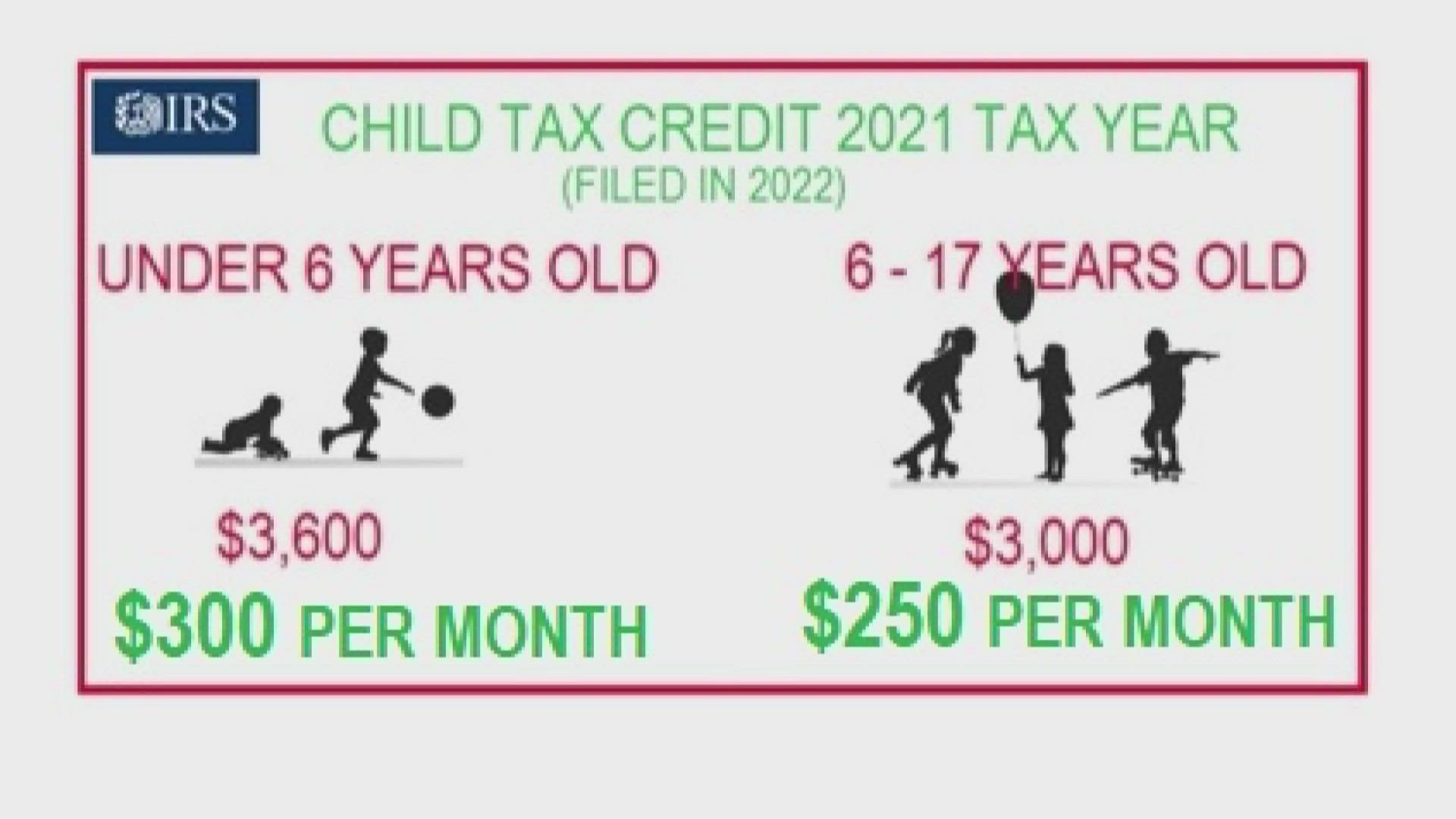

For children above the age of six it rose from 2000 to 3000.

. For tax year 2021. The maximum Child Tax Credit payment was 3600 for each qualifying child up to age 5 and 3000 for each child age 6-17. People who claim at least one child as their.

For kids under the age of 6 the credit went between 2000 and 3600 per child. Important changes to the Child Tax Credit will help many families. There is no minimum.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Families will get up to 300 a month for each child up to 5. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and.

And the maximum age was. Grandparents foster parents or people caring for siblings or other relatives should check their eligibility to receive the 2021 child tax credit. 1 1Advance Child Tax Credit Payments in 2021 IRS.

You are eligible for a property tax deduction or a property tax credit only if. The credit increased from. Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant during 2021.

Have a main home in the US. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. The Child Tax Credit program can reduce the Federal tax you owe by 1000 for each qualifying child under the age of 17.

The tax credit is aimed at helping parents. People who earn higher incomes still may be eligible for a smaller child tax credit depending on how much they earn. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17.

Property Tax DeductionCredit Eligibility. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child.

Eligibility for Advance Child Tax Credit Payments and. Half of the total amount came as six monthly. 3 3Eligibility Rules for Claiming the 2021 Child Tax Credit.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying. The maximum age requirement has been raised from 16 to 17. The child tax credit expansion increased the amount of money families can receive per child and expanded who can receive the payments.

Eligibility requirements have changed for the 2021 Child Tax Credit. Entered the required information in the Economic Impact Payment Non-Filers tool or the new Advance Child Tax Credit 2021 Non-Filer tool. If you were both a.

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Tas Tax Tips Free Help For Families To Get Advance Child Tax Credit Payments And Economic Impact Payments Taxpayer Advocate Service

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What The New Child Tax Credit Could Mean For You Now And For Your 2021 Taxes Newswire

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Guide To 2021 Child Tax Credit Amounts Eligibility Becu

2021 Advanced Child Tax Credit What It Means For Your Family

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

How To File For The Advance Child Tax Credit Payments In Milwaukee

Advance Payments Of The Child Tax Credit The Surly Subgroup

About The 2021 Expanded Child Tax Credit Payment Program

Feds Launch Website For Claiming Part 2 Of Child Tax Credit The Seattle Times

Pros Cons Of Advanced Payments Of The Child Tax Credit Cn2 News

Advance Child Tax Credit Payments Begin July 15 Navasota Examiner